The insurance industry, traditionally known for its paper-based processes and face-to-face interactions, is undergoing a profound shift. This metamorphosis, driven by rapid technological advancements and evolving customer expectations, is known as digital transformation in insurance. It’s not merely about digitizing existing forms or implementing a new CRM system; it’s a fundamental reimagining of how insurers operate, interact with customers, and deliver value.

In essence, digital transformation in insurance involves leveraging technology to enhance every aspect of the insurance value chain, from product development and distribution to underwriting, claims processing, and customer service. It’s about embracing innovation to create a more efficient, customer-centric, and data-driven industry.

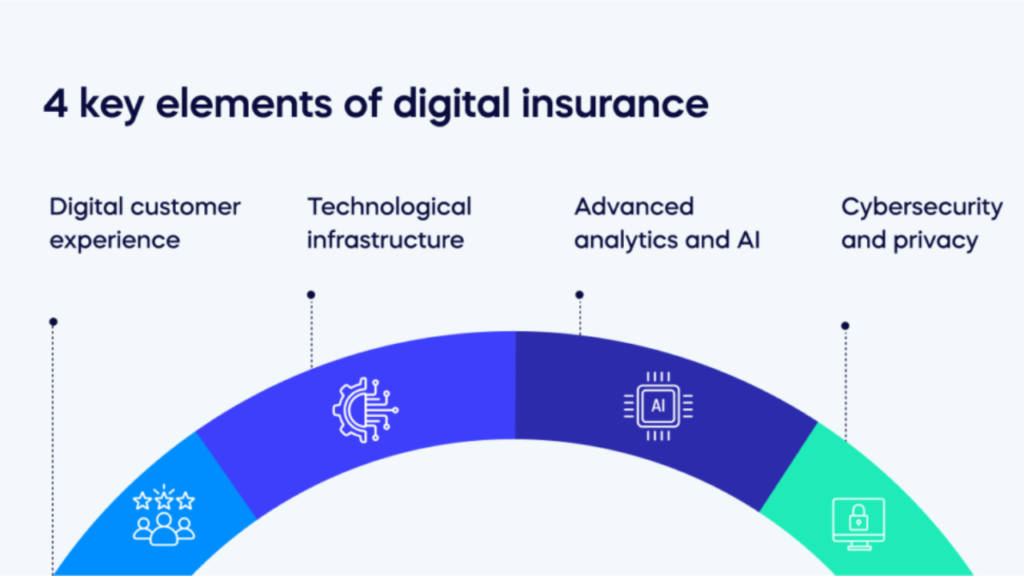

Understanding the Core Components of Digital Transformation in Insurance

Digital transformation in insurance is a multifaceted process encompassing several key areas:

1. Customer Experience Enhancement:

- Omnichannel Engagement: Today’s customers expect seamless interactions across various channels, including websites, mobile apps, social media, and chatbots. Insurers must provide a consistent and personalized experience regardless of the touchpoint.

- Personalized Products and Services: Leveraging data analytics and AI, insurers can tailor products and services to individual customer needs and preferences, offering customized coverage and pricing.

- Self-Service Portals and Mobile Apps: Empowering customers with self-service capabilities, such as policy management, claims filing, and payment processing, improves convenience and efficiency.

- Proactive Communication: Utilizing data insights to anticipate customer needs and provide proactive support, such as renewal reminders, risk alerts, and personalized recommendations.

2. Operational Efficiency and Automation:

- Robotic Process Automation (RPA): Automating repetitive tasks, such as data entry, document processing, and claims verification, frees up employees to focus on higher-value activities.

- Artificial Intelligence (AI) and Machine Learning (ML): Using AI and ML for tasks like fraud detection, risk assessment, and claims processing improves accuracy and speed.

- Cloud Computing: Migrating to the cloud provides scalability, flexibility, and cost-effectiveness, enabling insurers to access and manage data more efficiently.

- Straight-Through Processing (STP): Automating the entire claims process, from submission to settlement, reduces processing time and costs.

3. Data Analytics and Insights:

- Big Data and Analytics: Collecting and analyzing vast amounts of data from various sources provides valuable insights into customer behavior, risk patterns, and market trends.

- Predictive Modeling: Using data analytics to predict future risks, identify potential fraud, and optimize pricing strategies.

- Real-Time Data Access: Providing employees with real-time access to customer and policy data enables them to make informed decisions and provide personalized service.

- Internet of Things (IoT) Integration: Integrating data from IoT devices, such as telematics devices and wearable sensors, provides valuable insights into customer behavior and risk profiles.

4. Innovation and Product Development:

- Insurtech Partnerships: Collaborating with insurtech startups to access innovative technologies and solutions.

- Digital Product Development: Creating new digital insurance products and services that meet the evolving needs of customers.

- Open APIs: Developing open APIs to enable seamless integration with third-party platforms and services.

- Sandbox Environments: Creating sandbox environments to test new technologies and solutions before deployment.

The Benefits of Digital Transformation in Insurance

Implementing digital transformation initiatives can yield significant benefits for insurers, including:

- Enhanced Customer Satisfaction: Improved customer experience, personalized services, and seamless interactions lead to higher customer satisfaction and loyalty.

- Increased Operational Efficiency: Automation and streamlined processes reduce costs and improve productivity.

- Improved Risk Management: Data analytics and predictive modeling enable insurers to better assess and manage risks.

- Enhanced Fraud Detection: AI and ML algorithms can identify fraudulent activities more accurately and efficiently.

- Faster Claims Processing: Automation and STP accelerate claims processing, improving customer satisfaction and reducing costs.

- New Revenue Streams: Digital products and services create new revenue opportunities and expand market reach.

- Competitive Advantage: Embracing digital transformation enables insurers to stay ahead of the competition and adapt to changing market conditions.

Challenges and Considerations in Digital Transformation

While the benefits of digital transformation are clear, insurers must also address several challenges:

- Legacy Systems: Integrating new technologies with legacy systems can be complex and costly.

- Data Security and Privacy: Protecting customer data and ensuring compliance with data privacy regulations is crucial.

- Talent Acquisition and Development: Hiring and retaining skilled professionals with expertise in digital technologies is essential.

- Change Management: Implementing digital transformation initiatives requires a cultural shift and effective change management strategies.

- Regulatory Compliance: Navigating the complex regulatory landscape of the insurance industry can be challenging.

- Investment and ROI: Demonstrating the return on investment for digital transformation initiatives is important for securing funding and stakeholder buy-in.

- Cybersecurity Threats: With increased digitalization comes increased cyber threats, so robust cybersecurity measures are essential.

Key Technologies Driving Digital Transformation in Insurance

Several key technologies are driving digital transformation in the insurance industry:

- Artificial Intelligence (AI) and Machine Learning (ML): For risk assessment, fraud detection, claims processing, and customer service.

- Cloud Computing: For data storage, processing, and application deployment.

- Internet of Things (IoT): For collecting data from sensors and devices to assess risk and personalize services.

- Blockchain: For secure and transparent data sharing and transactions.

- Robotic Process Automation (RPA): For automating repetitive tasks and improving efficiency.

- Big Data and Analytics: For gaining insights into customer behavior, risk patterns, and market trends.

- Mobile Technology: For providing seamless customer experiences and self-service capabilities.

- API (Application Programming Interface): For seamless data sharing between platforms.

The Future of Digital Transformation in Insurance

The future of digital transformation in insurance is bright, with continued advancements in technology and evolving customer expectations. Insurers that embrace innovation and prioritize customer-centricity will be well-positioned for success.

- Hyper-Personalization: AI and data analytics will enable insurers to provide highly personalized products and services.

- Embedded Insurance: Insurance will be seamlessly integrated into other products and services, such as cars, homes, and travel.

- Usage-Based Insurance: Premiums will be based on actual usage and behavior, providing more accurate and fair pricing.

- Preventive Insurance: Insurers will focus on preventing risks rather than just indemnifying losses.

- Autonomous Claims Processing: AI-powered claims processing will become fully automated, reducing processing time and costs.

- Increased Collaboration: Insurers will collaborate with insurtech startups, technology companies, and other stakeholders to drive innovation.

Conclusion

Digital transformation is no longer an option for insurers; it’s a necessity. By embracing technology and prioritizing customer-centricity, insurers can enhance operational efficiency, improve customer satisfaction, and create new revenue streams. The journey of digital transformation requires a strategic approach, a willingness to adapt, and a commitment to innovation. Insurers that successfully navigate this transformation will be well-positioned to thrive in the evolving landscape of the insurance industry.