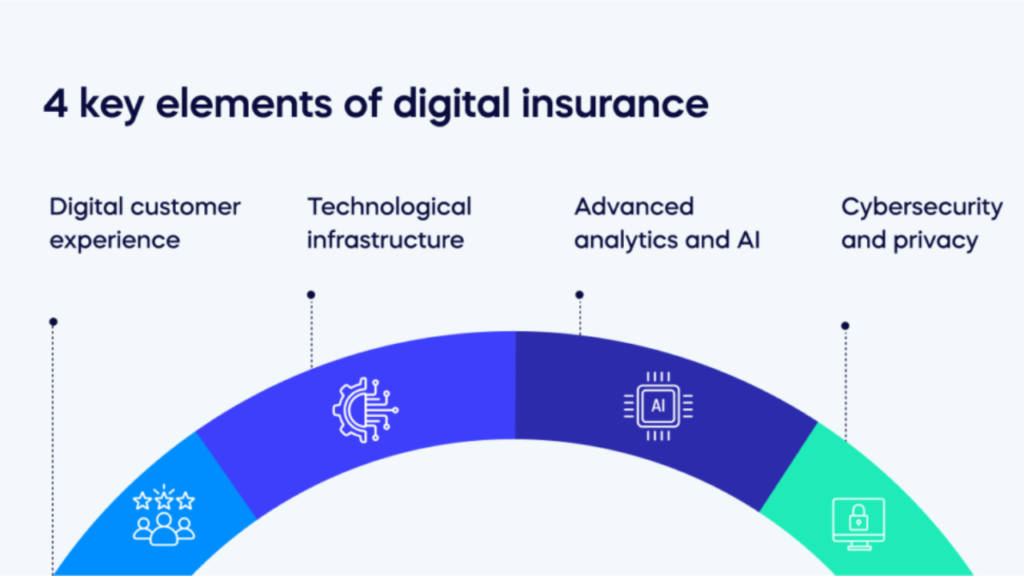

Digital insurance is transforming the way we perceive and interact with insurance. By leveraging technology, insurers are streamlining processes, enhancing customer experiences, and creating innovative products. This article delves into four key elements that are driving the digital insurance revolution.

1. Customer-Centricity: Putting the Customer First

In the digital age, customer experience is paramount. Digital insurance prioritizes customer needs and preferences, offering personalized solutions and seamless interactions.

- Personalized Experiences: Digital platforms collect data to understand individual customer profiles, allowing insurers to offer tailored policies and premiums. This level of personalization fosters stronger customer relationships and increases satisfaction.

- Omnichannel Engagement: Customers expect to interact with insurers across various channels, including websites, mobile apps, social media, and chatbots. A seamless omnichannel experience ensures customers can access information and services whenever and wherever they need them.

- Proactive Customer Service: Digital tools enable proactive customer service. Insurers can leverage data analytics to anticipate customer needs and proactively address potential issues, such as upcoming policy renewals or potential claims.

2. Data-Driven Decision Making: Leveraging the Power of Data

Data is the lifeblood of digital insurance. By harnessing the power of data analytics, insurers can gain valuable insights into customer behavior, market trends, and risk assessment.

- Risk Assessment and Underwriting: Advanced analytics, including machine learning and artificial intelligence, can analyze vast amounts of data to assess risk more accurately. This leads to more precise underwriting, fairer premiums, and improved risk management.

- Fraud Detection: AI-powered algorithms can detect fraudulent claims and activities, protecting both insurers and honest policyholders.

- Product Development and Innovation: Data analysis helps identify emerging customer needs and market opportunities, enabling insurers to develop innovative and relevant products.

3. Digital Platforms and Ecosystems: Building a Connected Insurance World

Digital platforms and ecosystems are transforming the insurance landscape, connecting insurers, customers, and third-party providers.

- Open Insurance: Open APIs allow insurers to share data and collaborate with other players in the ecosystem, such as fintech companies, telematics providers, and healthcare providers. This fosters innovation and creates new opportunities for value-added services.

- Embedded Insurance: Insurance products can be seamlessly embedded within other platforms and services, such as e-commerce platforms, ride-hailing apps, and IoT devices. This makes insurance more accessible and convenient for customers.

- Blockchain Technology: Blockchain can enhance transparency, security, and efficiency in insurance processes, such as claims processing and payments.

4. Technology-Enabled Processes: Automating and Streamlining Operations

Digital technologies are automating and streamlining various insurance processes, leading to increased efficiency and cost savings.

- Claims Processing: AI-powered tools can automate the claims process, reducing manual effort and speeding up claim settlements.

- Policy Administration: Digital platforms can automate tasks such as policy issuance, renewals, and changes, freeing up employees to focus on more strategic activities.

- Compliance and Risk Management: Technology can help insurers comply with regulations and manage risks more effectively.

The Future of Digital Insurance: A Seamless and Personalized Experience

The future of digital insurance lies in creating a seamless and personalized experience for customers. By combining customer-centricity, data-driven decision making, digital platforms, and technology-enabled processes, insurers can build a more efficient, innovative, and customer-focused industry.

As technology continues to evolve, we can expect to see even more exciting developments in digital insurance. From the rise of artificial intelligence-powered virtual assistants to the integration of blockchain technology, the future of insurance promises to be both exciting and transformative.

In conclusion, the four key elements of digital insurance – customer-centricity, data-driven decision making, digital platforms, and technology-enabled processes – are driving significant changes in the industry. By embracing these elements, insurers can not only survive but thrive in the digital age.

Keywords: digital insurance, customer-centricity, data analytics, digital platforms, technology-enabled processes, open insurance, embedded insurance, blockchain, AI, machine learning, automation, customer experience, risk management, innovation, future of insurance

Note: This article is for informational purposes only and should not be considered financial or legal advice.

I hope this comprehensive article meets your requirements!